The Transfer Balance Cap is the limit on how much superannuation can be transferred into the retirement phase. The Transfer Balance Cap was first introduced and applied on 1 July 2017, setting the cap at $1.6 million. The current Transfer Balance Cap is at $1.9 million and from 1 July 2025, it will be increased by another $100,000 increment, setting the new cap at $2 million due to inflation.

Attached is the General Transfer Balance Cap for the previous years:

Year | General transfer balance cap |

2025-26 | $2,000,000 |

2024–25 | $1,900,000 |

2023–24 | $1,900,000 |

2022–23 | $1,700,000 |

2021–22 | $1,700,000 |

2020–21 | $1,600,000 |

2019–20 | $1,600,000 |

2018–19 | $1,600,000 |

2017–18 | $1,600,000 |

Any amounts in excess of the cap will need to be transferred out of the tax exempt pension phase, either back to the accumulation phase (earnings taxable at 15%) or out of the superannuation system entirely as a lump sum. Although transfers to the tax exempt pension phase will be limited to $1.6 million, there are no restrictions on how much a Member can continue to hold in the accumulation phase. If your pension balance is over $1.6 million, you will need to make a request to convert part or all of your pension accounts into accumulation phase to ensure that your total pension balance does not exceed $1.6 million. You can download the minute template by clicking on the button below:

If you have a pension balance of over $1.6 million, you might need to purchase an actuarial certificate to determine which portions of the SMSF are taxed at 15% and which portions are tax free. For more information on actuarial certificates, please click on the button below:

If your total pension balance is over $1.6 million, you will not be able to use the segregated method for the SMSF’s assets. For more information, please see the Tax Office Video below:

Transitional CGT Relief Summary

The purpose of the transitional CGT relief is to provide temporary relief for certain CGT assets that will lose the tax exemption in complying with the new transfer balance cap and TRIS.

As Trustee of a super fund, you have access to temporary CGT relief if one or more of the Members in the SMSF are affected by the changes.

- Under the new transfer balance cap rules that commenced on 1 July 2017, a Member may need to reduce amounts currently supporting retirement phase super income streams. They may do this by transferring amounts back to the accumulation phase or withdrawing amounts from super.

- Under the changes that remove the tax-exempt status of assets supporting a TRIS, from 1 July 2017 you will lose the exemption for earnings from assets supporting TRIS and the earnings will be taxable. This is because TRIS will no longer be considered super income streams in retirement phase.

How to Apply CGT Relief

If the asset are held throughout the period 9 November 2016 to 30 June 2017, Trustees can choose to apply temporary CGT relief.

Applying CGT relief will:

- reset the cost base of an asset to its market value on the date of the asset transfer. This is where you reallocate or re-proportion assets from retirement phase to accumulation phase.

- defer a capital gain that arises when resetting the cost base for re-proportioning assets where you use the proportionate method.

Certain events that impact on the Transfer Balance Account must be reported to the Tax Office under Superannuation Transfer Balance Account Reporting regime (TBAR). For more information on TBAR Reporting, please visit our page here.

Our Approach

If your pension balance is over $1.6 million, we will automatically reset the asset cost base in a most tax effective manner to take advantage of the CGT relief.

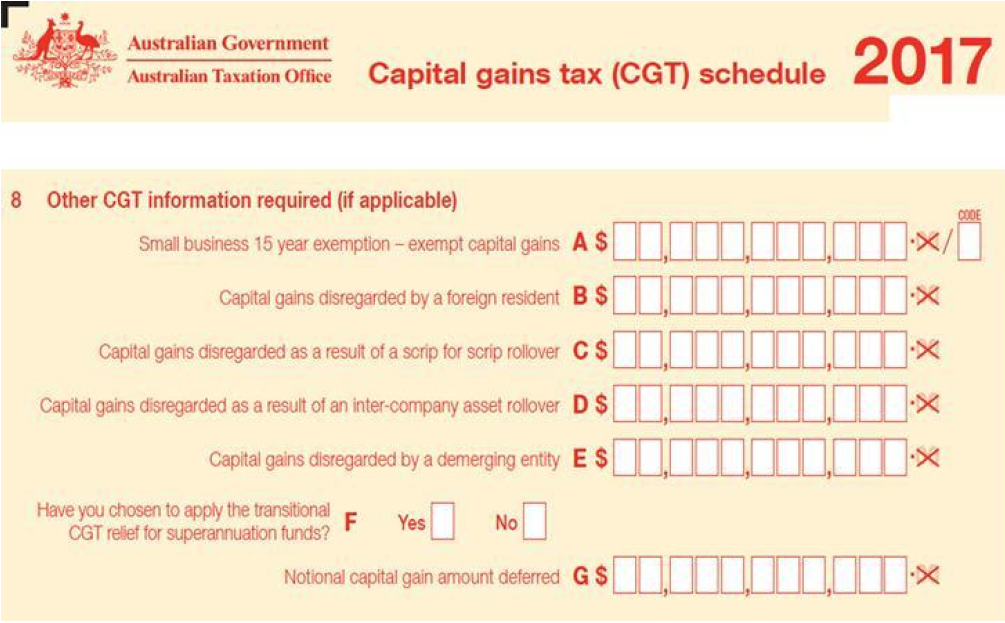

It is an ATO requirement to note the cost base reset in the SMSF Financial Reports and Tax Return. The below Tax Return extract shows where the cost base reset is reflected in the SMSF Tax Return.

- If a Member starts an accounts-based pension on or after 1 July 2021, their transfer balance cap will be 1.7 million.

- If the Members have an existing accounts-based pension and the 1.6 million cap was utilised in the past between 1 July 2017 – 30 June 2021, their transfer balance cap will be the same at 1.6 million.

- If the Members have an existing accounts-based pension and 1.6 million cap limit was never reached during the period 1 July 2017 – 30 June 2021, their transfer cap limit will be proportionally indexed based on their highest ever balance and would be between $1.6 and 1.7 million.

- If a Member starts an accounts-based pension on or after 1 July 2023, their transfer balance cap will be 1.9 million.

- If the Members have an existing accounts-based pension and the 1.6million cap was utilised in the past between 1 July 2017 – 30 June 2021, their transfer balance cap will be the same at 1.6 million.

- If the Members have an existing accounts-based pension and 1.6 million cap limit was never reached during the period 1 July 2017 – 30 June 2021, their transfer cap limit will be proportionally indexed based on their highest ever balance and would be between $1.6 and 1.9 million.

- If a Member starts an accounts-based pension on or after 1 July 2025, their transfer balance cap will be 2 million.

- If the Members have an existing accounts-based pension and the 1.6million cap was utilised in the past between 1 July 2017 – 30 June 2021, their transfer balance cap will be the same at 1.6 million.

- If the Members have an existing accounts-based pension and 1.6 million cap limit was never reached during the period 1 July 2017 – 30 June 2021, their transfer cap limit will be proportionally indexed based on their highest ever balance and would be between $1.6 and $2 million.