In-house assets are investments, loans or leases to Fund Members and related parties of the SMSF. You are restricted from lending to, investing in or leasing to a related party of the Fund for investments totaling more than 5% of the SMSF’s assets. There are some exceptions, including for business real property that is subject to a lease between the Fund and a related party of the Fund.

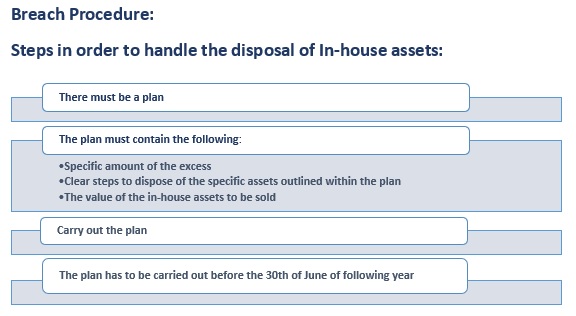

At the end of each financial year you have to apply the ‘in-house asset rule’ using market values to make sure the level of in-house assets held is still less than 5% of the Fund. If the market value of an in-house asset increases or the value of the Fund’s assets fall you’ll need to dispose of some of the SMSF’s in-house assets to ensure the SMSF is compliant.

Definition of an in-house asset

The basic definition of an in-house asset is one of the following:

- A loan to or investment in a related party of the fund.

- An investment in a related trust of the fund.

- An asset subject to a lease arrangement between the trustee and a related party of the SMSF.

There are a number of exemptions from the definition of an in-house asset and these are:

- Commercial property that is leased to a related party on an arm’s-length basis.

- Investments in non-geared related unit trusts or companies that meet a range of strict requirements.

- Loans to a related party and investments in related unit trusts and companies that were set up prior to 11 August 1999.

Assets owned by an SMSF with a related party as tenants in common will not be an in-house asset simply because the SMSF and its related party share ownership. In this case, it will depend on whether the asset owned is itself an in-house asset.

Related party

An SMSF’s related parties are any of the parties below:

- Any member of the SMSF;

- A Part 8 associate of any fund member or standard employer-sponsor.

A Part 8 associate (so named because it comes from Part 8 of the SIS Act) (See Legislation and Rules on this page) of an SMSF member includes a relative, business partner (including their spouse and child), the trustee of a trust controlled by the member, and a company sufficiently influenced by the member or in which the member holds a majority voting interest.

Investment in certain non-geared unit trusts and companies

The non-geared entity exemption provides a more flexible way for an SMSF to purchase and hold property jointly with related parties.

Instead of purchasing a property directly, the SMSF and related parties purchase units in a unit trust or company. The trust or company then purchases the property. One of the key benefits of this structure is that it will generally allow the SMSF to increase its ownership over time by acquiring further units or shares from the existing related party owners. This is allowed because of a specific exemption from the general rule prohibiting SMSFs from acquiring assets from related parties.

An investment by an SMSF in a non-geared entity that meets the rules set out in SIS Regulation 13.22B or 13.22C is not an in-house asset. The rules are designed to significantly limit the activities of the trust or company, and include the requirement not to:

- Borrow or allow a charge over any assets.

- Run a business.

- Hold an interest in another entity (e.g. a unit trust would not meet this exemption if it held units in another trust or shares in a company).

- Loan money to another entity.

- Lease an asset to a related party, except if the asset is business real property. or

- Acquire an asset from a related party of the SMSF after 11 August 1999.

Failure to comply with the rules listed above will bring the exemption to an end and any interest held by the SMSF will become an in-house asset.

Extra information

For the ATO’s definition of an in-house asset, click here. For further information on in-house assets, visit Running a business in an SMSF at this page.