This could happen when the Trustees did not demonstrate the knowledge that the ATO officer deemed necessary to fulfill their roles as Trustees of the Fund or the necessary documents required by the audit letter are not received by the due date.

In this case, a written request for a review to withhold the ABN of the Fund needs to be sent directly to the ATO officer from the Trustees to update the ABN status of the Fund to complying

If the ATO officer decides that the Trustees do not have the capability to undertake the responsibilities of the Trustees and the Trustee’s personal tax affairs are still not resolved by the due date noted on the audit notification letter, the ATO officer may make the decision to cancel the ABN of the Fund.

Once the SMSF has been given a ‘Registered’ or ‘Complying’ status on Super Fund Lookup it is ready for operational use. We give further guidance in relation to transferring benefits into a Self-Managed Super Fund in the link below.

When a Fund is first established, the ATO may initiate an Audit as part of the establishment process.

The Tax Office have a set of initial checks and vetting processes which need to be completed before a Fund can be listed as ‘Registered’ or ‘Complying’ on Super Fund Lookup. To our experience, the Tax Office will generally list the Funds status on Super Fund Lookup as ‘Regulation Details Withheld’ during the ATO Audit process. This means the Fund will be unable to receive contributions or rollovers while the Fund is being reviewed by the Tax Office.

The objective of the review/audit is to ensure that the associates of the SMSF do not have any ATO compliance issues for example:

- Outstanding personal tax returns

- Involvement with another SMSF whose tax return has not been lodged up to date

- Previous involvements with companies or individuals that have been declared bankrupt

If the Trustees have any outstanding ATO compliance issues, an ATO audit might be triggered.

Next steps if there is an ATO audit on the SMSF

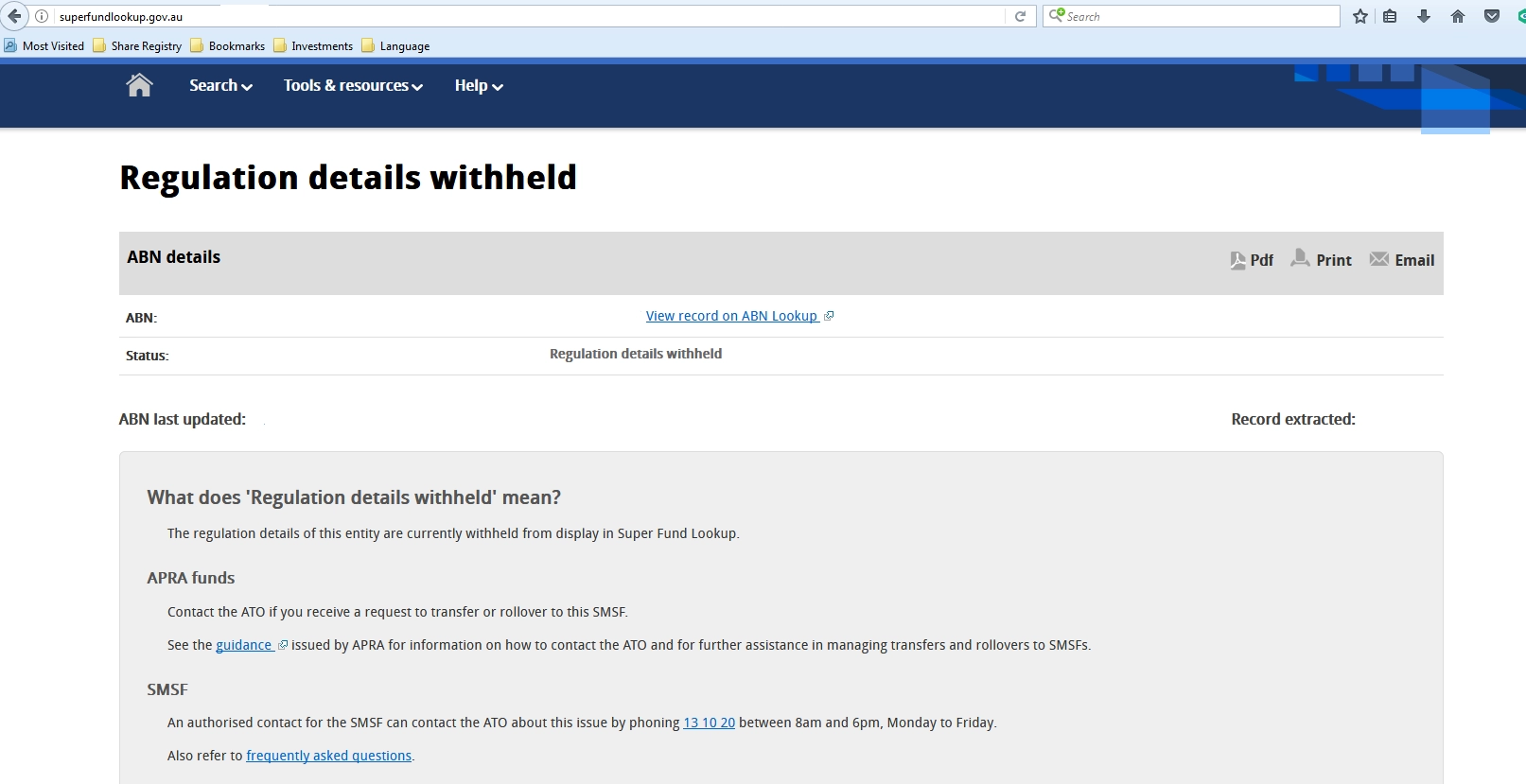

Generally, the ATO will first withhold the ABN of the Fund. Once the ABN of the Fund is withheld, the Fund is unable to accept any rollovers. On the Super Fund Look Up website, the ABN of the Fund will appear as per the print noted below:

An ATO officer may then be assigned to the Fund and a notification letter is sent to the Trustee. For a sample of the notification letter, please click on the button below:

If you are a client of Superannuation Warehouse we provide direct assistance with completing the ATO Audit process of which there are essentially 2 separate parts which the Tax Office conduct.

Source Document Review

The Tax Office will request a series of establishment documents from you as Trustee which they must review and ensure are correct and accurate. The documents they require consist of the following signed permanent files for the Fund and additional supporting documents relating to the Funds operation:

- Trust Deed

- Investment Strategy

- Initial Minutes of Meeting

- Trustee Consent and Member Application

- ATO Trustee Declarations

- Bank Confirmation Letter

Please ensure once the Fund has received its Australian Business Number that you proceed with applying for a Bank Account for the SMSF. It is important that the Tax Office see that a Bank Account has been applied for in the name of the SMSF. The ATO will request a ‘Bank Confirmation Letter’ noting the BSB, Account Number, Account Name and that the Bank Account has been opened on a ‘Pro-Forma’ status. Please ensure the SMSF Bank Account is held separately from any assets held by the trustee personally. Section 52(2)(d) of the SIS Act requires assets of a superannuation fund to be held in the name of the SMSF and not in the Trustees personal name.

- Retail/Industry Super Statements

- Payment receipt for SMSF establishment and setup

Trustee Interview

Once the Tax Office have received the above-mentioned documents, they will need to conduct a Trustee interview. This is done over the phone and the interview time and date will be planned in advance by the specific ATO Auditor assigned to the Fund. You can find assistance and information in relation to passing the Trustee Interview with a Free Education Course on our website. Please see the link below for the Free Trustee Education Course.

The Tax Office also offers comprehensive online courses designed to assist Trustees in effectively managing a Self-Managed Super Fund (SMSF). Completing these courses can enhance Trustees’ understanding and help ensure compliance during an ATO audit.

The ATO recommends that Trustees complete the following three courses:

- Setting up a self-managed super fund (SMSF)

This course provides guidance on establishing an SMSF, including choosing a trustee structure, creating a trust deed, and registering the fund. - Running a self-managed super fund (SMSF)

Learn about managing contributions, investments, and benefits, as well as meeting reporting and administrative obligations. - Winding up a self-managed super fund (SMSF)

Understand the steps involved in closing an SMSF, including preparing an exit plan, distributing benefits, and finalising compliance requirements.

To access these courses, please visit the Essentials to Strengthen Your Small Business website. Creating an account will allow you to track your progress and download certificates upon completion. If you are unable to download the certificates, please save screenshots as proof of completion.

Finalisation of the Audit Process

Once the Tax Office have completed the Audit process for the Fund they will conduct a series of background checks. These background checks are done in conjunction with other regulators and is done to decide on whether the individual will be eligible to act as a Trustee or Corporate Trustee Director. The Tax Office may look into your previous tax return lodgement history. To minimize the change of an ATO audit, Trustees should ensure that their personal tax affairs are up-to-date before setting up an SMSF.

The ATO may take up to 56 business days to complete the entire ATO Audit process. Trustees are encouraged to assist the Tax Office with all enquiries they may have in regards to the Funds operations.

What happens after an ATO audit

The objective of the ATO audit is to display the status of the Fund as a complying SMSF. If the ATO identified potential issues, they will come to one of the following decisions (click to expand):