Paying Benefits From Your SMSF – Lump Sum

A Lump Sum Benefit Withdrawal is simply a payment from an SMSF in a Lump Sum. This is different to an SMSF withdrawal paid out over a period of time, like a Pension or a Transition to Retirement, also known as TTR. A Lump Sum benefit is a one-off payment from the SMSF to a Member who has satisfied a condition of release – for example, age criteria met, retirement, death or Lump Sum payments for a deceased Member.

Pension payments are required to be paid in cash, however Lump Sum payments have the option of being taken out in cash or in-specie. The term “Lump Sum” is defined in the superannuation legislation [SIS Reg 6.01(2)] as “including an asset”, which means lump sums can be paid in-specie. This gives you the option of taking out a Lump Sum payment in the form of an asset, such as shares or property. This is helpful because it removes the time-consuming process of liquidating SMSF assets into cash in order to make pension payments.

Generally, you are eligible to access a Lump Sum withdrawal without restrictions once you have turned 65 years old, or once you have reached the preservation age and you are retired.

If you have commenced a Pension from your SMSF, you can still take out Lump Sum withdrawals once you have turned 65 years old, or you are over 60 and retired. There is no restriction to the amount that you can take out as a Lump Sum payment from your SMSF.

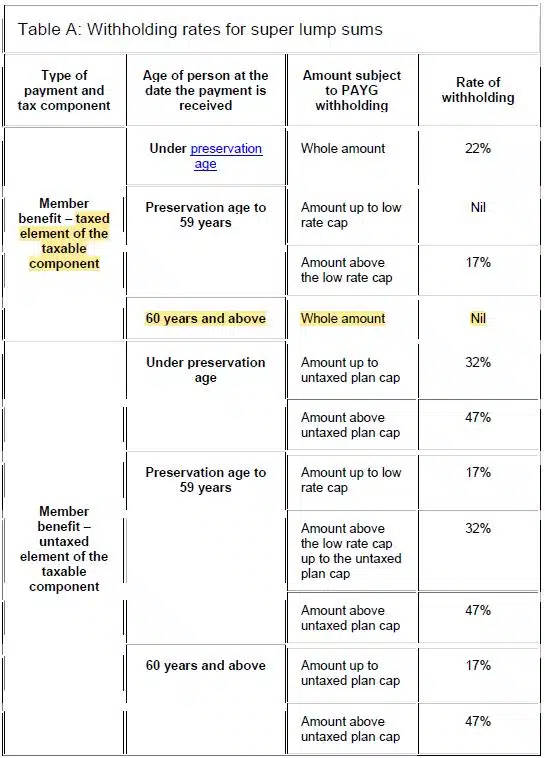

There was a term called the “Low Rate Cap Amount” that was relevant with payments under 60. With ages moving up, this is less relevant now, but still good to know. The tax consequences of taking more than $245,000 (for 2024-25 and indexed each year) as a Lump Sum is discussed here with the ATO tables.

To download a Lump Sum Pension Minute template, please click on the link below:

Personal Income Tax Considerations

When making a Lump Sum payment to Members, the SMSF is required to register for PAYG as soon as they know tax is to be withheld from the Lump Sum payments or income streams.

There are 2 scenarios that can happen:

- For Members who are up to 60 years old, the SMSF must withhold tax from benefit payments, both as Pensions or Lump Sums.

- The SMSF is also required to withhold tax for a Member who is 60 years and over if their benefit payments contain an untaxed element.

- Note that the taxable component of your Lump sum withdrawal is tax-free up to the low-rate threshold ($245,000 for 2024-25 and indexed each year). Amounts over the threshold will be taxed at the rate of 15% (plus the Medicare Levy).

- No withholding tax is required from the benefit payments if the Member

- Is over 60 years old and the benefit is from a taxed source.

- Has died and a benefit is paid to a dependent beneficiary as a Lump Sum.

- Has a terminal medical condition.

- Was a member of the defence force, police or protective service and died in the line of duty and a Lump Sum payment is made to a non-dependent.

Below is the snapshot of the tax rate table on super lump benefits.

Please also see the ATO website for the Schedule 12 – Tax table for superannuation lump sums.

Lump Sum Paper Work

To withdraw from your super as a Lump Sum, you will first need to determine the components of your super balance. Your SMSF balance may consist of preserved, tax-free, taxable and un-taxed components. Depending on what the tax components are, you may want to consider what the best retirement strategy is for you and your SMSF before you withdraw a Lump Sum. After you have the information required to process a Lump Sum withdrawal or Pension payment, you will need to complete the following:

- Review your Trust Deed to ensure nothing prevents the SMSF from paying a TRIS.

- Prepare a letter from the Member to the Trustee requesting a Lump Sum Pre-payment Statement.

- Complete Part 1 of theLump SumPre-payment Statement. This provides details of the components of the super benefit and gives the Member an opportunity to seek advice regarding the treatment of the payment.

- Arrange for the Member to complete Part 2 of the Lump Sum Pre-payment Statement. Alternatively, the Member can prepare a letter to the Trustee stating how they want to be paid, whether it will be in cash, in specie or both.

- Fill in the PAYG Payment Summary – Superannuation Income Stream form. Once completed, send a copy to the Member with the Lump Sum payment and send a copy to the ATO to be lodged within 14 days of payment. This is not required for Members aged 60 or above as there is no tax payable, unless the Lump Sum is paid from an un-taxed source.

- If the Member is receiving property as part of the Lump Sum payment, then a Minute is required from the Trustee to record this. The Minute needs to record the details of the asset, including the asset’s value and the Minute must record that the asset is being vested to the Member in specie.

- Prepare the accounting records and entries to reflect the Lump Sum payments and ensure the appropriate components are updated in accordance with the proportioning rule.

TBAR Reporting

From 1 July 2018, the Tax Office introduced a new reporting regime for Members with Pension accounts, this is referred to as TBAR. If Members take out a Lump Sum withdrawal, it should be reported to the ATO by lodging TBAR. When instructed, we can lodge a TBAR on your behalf.

Please see our TBAR page in the link below for more detail on the reporting events and times frames.