Age pension is a government funded lifetime annuity. It provides income support to a range of concessions for eligible older Australians. Age Pension is paid at different rates depending on a person’s circumstances.

To be eligible for age pension, you need to meet the following conditions:

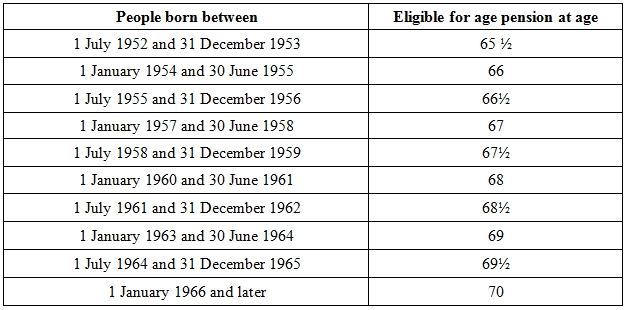

Meet the Qualifying age

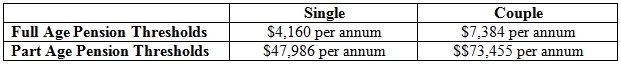

Satisfy the Income Test

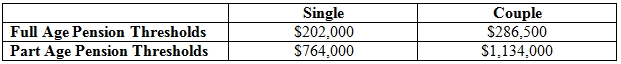

Satisfy the Assets Test

If you meet the above tests, Centrelink will then calculate your rate of pension or allowance based on the lower of the two amounts calculated under the Income Test and the Assets Test.

The Centrelink treatment of account-based pensions changed from 1 January 2015. Any account-based pension commenced on or after 1 January 2015 will all be treated as a financial asset and counted towards the Income Test. For any account-based pensions commenced prior to January 2015 where the pensioner is in receipt of Centrelink benefits at 1 January 2015, the account-based income streams you receive will be grandfathered under the existing rules and therefore partially exempt for the Income Test.

For more information on Age Pension, please see here.

Members of an SMSF can also start paying themselves benefits once they reach their preservation age. To know how to commence a pension in an SMSF, please see here.