- Home

- SMSF Setup

- Running SMSF

- Transferring Benefits into your SMSF

- Income in an SMSF

- Expenses in an SMSF

- Bank Accounts

- Insurance

- Members

- Unlock Growth Potential with SMSF Contributions

- Personal Super Contributions

- Government Co-contribution

- Low Income Super Tax Offset

- Spouse super contribution

- Contribution Splitting

- Personal Concessional Contribution

- Small Business Exemptions

- Concessional Contributions

- Non-Concessional Contributions

- Salary Sacrifice

- Carry Forward Concessional Contributions

- Bring-Forward Non-Concessional Contributions

- First Home Super Saver Scheme

- Downsizer Contributions Into Superannuation

- Pensions

- Estate Planning

- Guide to SMSF

- Reserves

- Advice

- NIL SMSF Returns

- Closing down an SMSF

- Services

- Investments

- SMSF Audit

- About Us

- Resources

- Single Member SMSFs

- Residency Rules

- Education

- Power of Attorney (POA)

- Illegal access to Super

- Foreign Account Tax Compliance Act (FATCA)

- Financial Advice

- Robo Advice

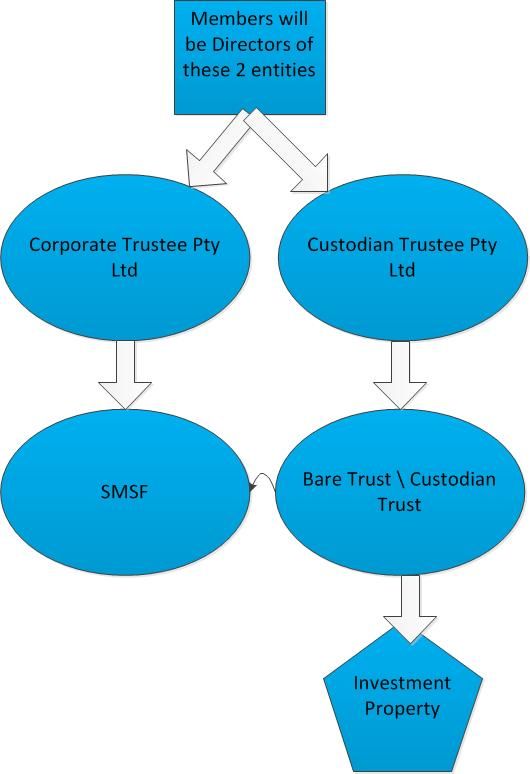

At Superannuation Warehouse, we specialise in SMSF administration. We can execute the setup of a Bare Trust structure where the Trustees have decided to purchase a property with loans. The typical structure is set out below:

Bare Trust Structure

SMSFs can invest in commercial or residential property; however, neither Trustees nor related parties are permitted to live in the property or use the property as a holiday house. The sole purpose of the property must be as an investment of your SMSF.

Some important points regarding SMSF propertyinvestment

- It is important that the SMSF, including the structure above, is set up before you invest in any property. An SMSF can’t borrow money in its own right; hence, a Bare Trust structure must be put in place to facilitate the loans.

- The only purpose of the Bare Trust (also referred to as a Property Trust) is to keep title over the investment property until the loan is paid off.

- All property-related costs can be paid by the SMSF.

- The SMSF receives rental income and pays for all operating expenses and loan repayments.

- In this particular structure only one property is allowed.

- The property will revert back to the SMSF when the loan is repaid.

- Funds can be borrowed from the Trustees or the bank, or a combination of both.

- The loan type a bank can offer the SMSF is known as a limited recourse loan. Limited recourse means that, should the loan default, the bank has no right of recourse on the SMSF’s other assets.

- For this reason banks usually ask for a personal guarantee over the property from Trustees.

- With member-guaranteed loans, the maximum Loan-to-Valuation Ratios (LVRs) are usually around 80% for residential properties and 70% for commercial.

- When there’s a bank loan with a 60% LVR, the bank may waive the requirement for a guarantee from the Trustees.

- Trustees can also lend to the SMSF, so it’s possible to do it without a bank.

- Trustees can borrow from the bank and then on-lend to the SMSF – this tends to make the administration easier.

- The Bare Trust and Corporate Trustee are merely the legal entities that hold the property – all transactions take place within the SMSF.

- Superannuation Warehouse charges a one-off fee to set up these entities, after which there is no additional fee for their maintenance (it’s included in your fixed monthly fee).

An SMSF cannot normally take out loans per se. However, in order to purchase a property, an SMSF can use a Limited Recourse Borrowing Arrangement. To do this, the Trustees must provide the bank with a guarantee for the loan. You might want to use a mortgage broker to help you find the most suitable loan for your circumstances from a panel of lenders.

Repair and Maintenance

The cost of any repairs and maintenance undertaken on an investment property can be deducted in the SMSF. To find out more about the differences between repairs and improvements, click here and view the ATO guidelines.

What name should the SMSF use with property investment?

Rules differ in each state, so please verify titles below with a legal professional. Generally, use the Custody Trust’s name. For example:

- For an individual trustee, “John Summers ATF Declaration of Custody Trust for the ABC Super Fund”

- For a corporate trustee, “ABC Pty Ltd ACN number ATF Declaration of Custody Trust for the ABC Super Fund”

Land registries don’t generally accept any reference to a Custodian Trust. The transfer of land should simply be registered in the name of the Custodian Trustee, for example:

- When the Custodian Trust uses individual trustees, use the names of the individuals, e.g. ”John Summers and Sarah Summers”

- When the Custodian Trust uses a Custodian Trustee, use the name of the Custodian Trust, e.g. “ABC Custody Pty Ltd ACN number”.

When the loan is paid off, there is no need to keep the Custodian Trust. The property will then revert back to the SMSF. There should be no stamp duty implications as there is no change in beneficial interest in the property.

For more info on how you can invest in property in your SMSF, please watch the video below.

Lastly, as the Fund purchases an investment property, there are many documents that you need to keep on your records and provide them to us when we prepare the Annual Return for your Fund. To assist you with this, please use the Checklist we provided in the link below when the Fund start to purchase the asset.

Have Questions?

Ask Superannuation Warehouse experts

We are Melbourne based with clients throughout Australia. Our SMSF administration service is mostly paperless. This enable us to charge a fair fee, resulting in a good value-proposition for you.

Superannuation Warehouse is an accounting firm and do not provide financial advice. All information provided has been prepared without taking into account any of the Trustees’ objectives, financial situation or needs. Because of that, Trustees are advised to consider their own circumstances before engaging our services.

Follow us:

Shop 1/116 Balcombe Rd, Mentone, VIC 3194

PHONE:

03 9583 9813

0411 241 215

Email:

admin@superannuationwarehouse.com.au

Office Hours:

Monday to Friday

9.00am – 5.00pm