- Home

- SMSF Setup

- Running SMSF

- Transferring Benefits into your SMSF

- Income in an SMSF

- Expenses in an SMSF

- Bank Accounts

- Insurance

- Members

- Unlock Growth Potential with SMSF Contributions

- Personal Super Contributions

- Government Co-contribution

- Low Income Super Tax Offset

- Spouse super contribution

- Contribution Splitting

- Personal Concessional Contribution

- Small Business Exemptions

- Concessional Contributions

- Non-Concessional Contributions

- Salary Sacrifice

- Carry Forward Concessional Contributions

- Bring-Forward Non-Concessional Contributions

- First Home Super Saver Scheme

- Downsizer Contributions Into Superannuation

- Pensions

- Estate Planning

- Guide to SMSF

- Reserves

- Advice

- NIL SMSF Returns

- Closing down an SMSF

- Services

- Investments

- SMSF Audit

- About Us

- Resources

- Single Member SMSFs

- Residency Rules

- Education

- Power of Attorney (POA)

- Illegal access to Super

- Foreign Account Tax Compliance Act (FATCA)

- Financial Advice

- Robo Advice

Property Investment in the USA

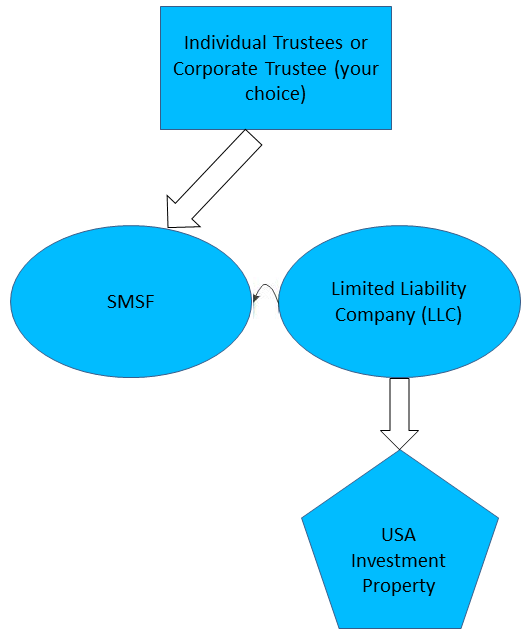

A strategy that is currently gaining popularity is to use your SMSF to purchase property in the USA. The typical structure for USA property investment is set out below:

Note: The SMSF owns 100% of the LLC. The LLC has 100% ownership of the USA investment property and the USA bank account.

Why would you purchase property in the USA?

There are two main reasons: properties in the USA cost less than in Australia (typically between $40k and $150k); and the rental yield is higher (between 7% and 22%).

For guidance on real estate in US, please see here.

Steps involved

First, you need to locate a suitable property in the USA. You can use a buyer’s advocate to do this. Next, you set up an LLC, open a US bank account, and transfer your funds from Australia.

A property manager will receive the rental income for an arranged fee plus maintenance costs. The net rental will be deposited into your US bank account.

An LLC is a flow-through vehicle for tax purposes. In some US states, LLC Taxes are levied at state level. Any taxes levied in the USA can be claimed back as a credit in Australia thanks to the double tax agreement between the two countries.

A number of companies promote US property. Do a Google search to identify properties. Popular areas to purchase property include:

Dallas, Texas, Memphis, Tennessee, Miami, Florida, Atlanta and Georgia.

Steps involved in setting up an LLC in Florida, USA

First, you’ll need a registered agent in the USA. These guys provide their services for free:

www.freeregisteredagent.com

Here is the website where you can file online for the Articles of Organization that you’ll need to start an LLC in the state of Florida:

https://efile.sunbiz.org/llc_file.html

To set up an EIN (free)

- Your LLC must be incorporated and you must have the Articles of Organization.

- Complete an SS-4 Form.

- Call the IRS on 0011-1-267-941-1099 (not toll free).

- Explain that you need an EIN for an LLC in Florida (for example) and tell them why.

- They’ll ask you to fax the completed SS-4 form to 0011-1-267-941-1345 (and they’ll stay on the line while you’re doing this).

- Fax the form and wait for them to issue the EIN over the phone.

- They’ll also send you a letter by regular mail to confirm the EIN. Be sure to make several copies of the letter; you’ll need them in the future.

USA Property Assistance

There are companies specialising in assisting SMSF’s in investing in the USA. One such company is Star Dynamic (contact person is Lindsay Stewart 9973 4767). They have an office in Melbourne and focus on Texas, Michigan and Florida although they advise on USA property throughout. The reason for this area is good historical and projected growth rates and rental yields. Combined with a low rate of natural disasters, this is seen as a good area to invest in.

Here are 3 examples of recently sold properties by the company above:

Lastly, remember the Investment Strategy of the SMSF must allow for overseas property investments. When setting up a new SMSF, we issue an Investment Strategy allowing for overseas property investments. You can download an Investment Strategy template here.

Please see our page for more information on double tax agreement.

Have Questions?

Ask Superannuation Warehouse experts

We are Melbourne based with clients throughout Australia. Our SMSF administration service is mostly paperless. This enable us to charge a fair fee, resulting in a good value-proposition for you.

Superannuation Warehouse is an accounting firm and do not provide financial advice. All information provided has been prepared without taking into account any of the Trustees’ objectives, financial situation or needs. Because of that, Trustees are advised to consider their own circumstances before engaging our services.

Follow us:

Shop 1/116 Balcombe Rd, Mentone, VIC 3194

PHONE:

03 9583 9813

0411 241 215

Email:

admin@superannuationwarehouse.com.au

Office Hours:

Monday to Friday

9.00am – 5.00pm