Individual Tax Rates are very important when it comes to managing your Self-Managed Super Fund as they can determine whether or not making concessional contributions to your SMSF is tax advantageous or not.

As such, although we are specialised SMSF Accountants we are also affiliated with the National Tax & Accountants’ Association (NTAA) as a Member and they have put together a booklet with useful tax tables and detailed information regarding taxes on various entities. See the button below for a link to the NTAA Booklet

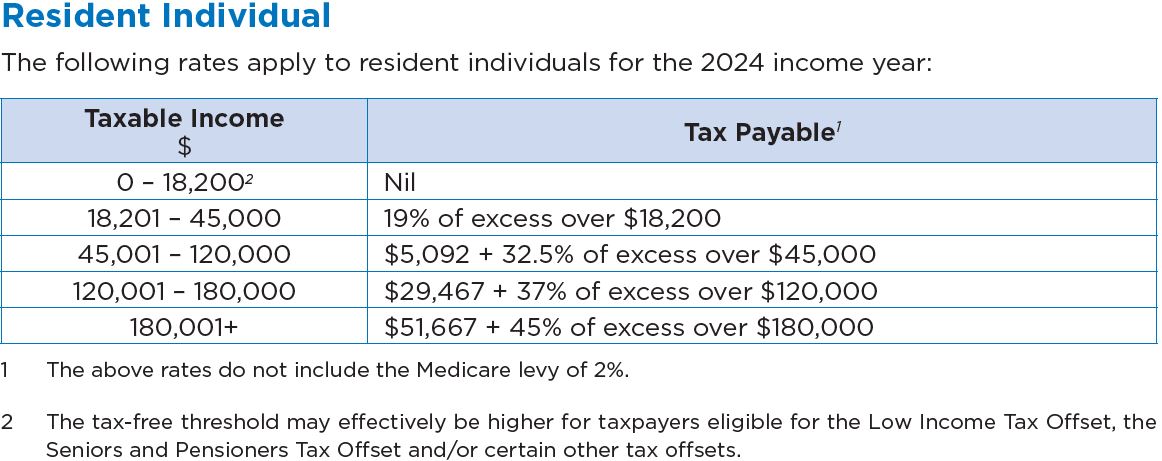

We have extracted some information from the Booklet that is useful. These are the Individual Resident Tax Rates for the 2024 Financial Year. Note that they remain unchanged from the 2023 and 2022 Financial Year.

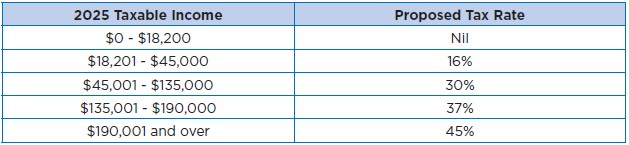

Recent changes to the Tax rates have been approved, amending the tax return applicable for the 2025 Income Year. A summary of the amended Tax Rates are outlined below:

The following table shows taxes on Non-resident Individuals for the 2024 Financial Year.

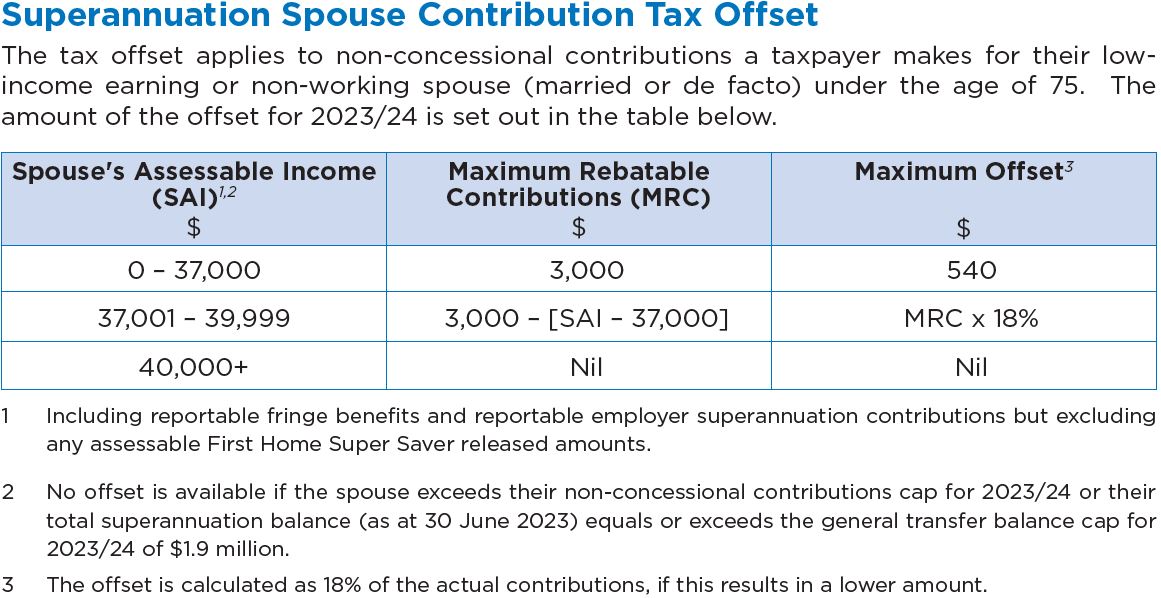

Spouse Contribution Tax Offset

Taxpayers can receive a Spouse Contribution Tax Offset when they make a non-concessional contribution to their Spouse’s Super. See the table below from the NTAA regarding the tax offset.

For more on spousal contributions in an SMSF please see the link here.

Government Co-Contribution

If a Member makes a non-concessional contribution into their super and if they meet all the eligibility criteria and is a low or middle income earner they can receive a government co-contribution of up to $500. Below are the Tax Tables from the NTAA.

More information on the Government Co-Contribution can be found here.

Super Tax Savings

One of the main methods of creating an effective tax strategy is to contribute into super. Concessional contributions made into your super are taxed at an effective rate of 15%. The amount that is contributed to your super can be claimed as a personal tax deduction. For more information on how super is taxed in an SMSF, please see the link here.