Concessional contributions are contributions that are made into your SMSF before tax. Concessional contributions include the following:

- Employer Contributions (Currently 12%)

- Salary Sacrifice Arrangement

- Transfers from reserves

- Personal Concessional Contribution

From 1 July 2024, the concessional contribution cap for each year is $30,000 and the tax rate on concessional contributions below the cap is generally 15%. For more information on concessional contribution cap, please click here.

High-income earners:

For those that earned more than $250,000 a year, under Div 293, the tax rate on concessional contributions is 30%. The ‘Income’ in this context is the sum of the taxable income, concessional contributions, adjusted fringe benefits and total net investment losses.

Low-income earners:

People who has taxable income of less than $37,000 do not incur contribution taxes on their concessional contributions. Specifically, the contribution taxes will be returned to their super account, with a maximum amount up to $610.5 (11% x $37,000 x 15%).

Excess concessional contributions

When contributions in excess of the concessional contributions cap (general cap of $30,000 per annum as of 1 July 2024) is made to an SMSF, an additional tax is applied to the Members of the Fund.

From 2014 onwards, if concessional contribution exceeds the cap, the excess amount will be included in your personal assessable income and taxed at the marginal tax rate. The Tax Office will then send you a letter (determination) and a notice of assessment. In addition, they will provide more details for the next steps that need to be taken by the Trustees.

From 1 July 2018, Members can make ‘carry-forward’ concessional super contributions if they have a total superannuation balance of less than $500,000. Members can access their unused concessional contributions caps on a rolling basis for five years. Amounts carried forward that have not been used after five years will expire. The first year in which you can access unused concessional contributions is the 2020 financial year.

For more information, please refer to the ATO Website.

Super guarantee percentage

The Super guarantee percentage will gradually increase to 12% as follows:

| Period | Super guarantee (%) |

|---|---|

| 1 July 2002 – 30 June 2013 | 9 |

| 1 July 2013 – 30 June 2014 | 9.25 |

| 1 July 2014 – 30 June 2021 | 9.5 |

| 1 July 2021 – 30 June 2022 | 10 |

| 1 July 2022 – 30 June 2023 | 10.5 |

| 1 July 2023 – 30 June 2024 | 11 |

| 1 July 2024 – 30 June 2025 | 11.5 |

| 1 July 2025 – 30 June 2026 and onwards | 12 |

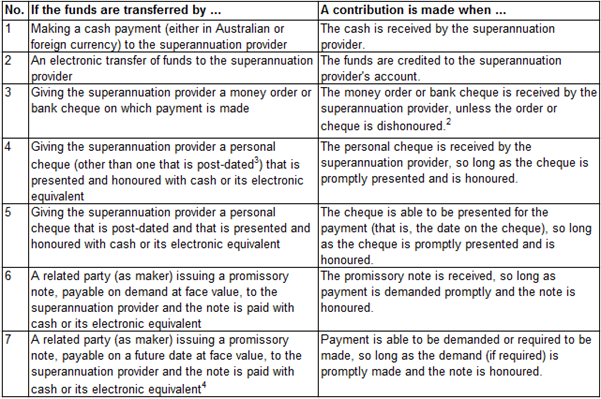

Timing of contributions

Generally, a contribution is recognized and recorded in the year when cash is received by the SMSF. Taxation Ruling 2010/1 provides direction with respect to timing of contributions.