The super co-contribution scheme is a payment the Government makes to help eligible Members boost their retirement savings. The Tax Office uses information (income testing) from your personal tax return and the contribution information from your SMSF to work out whether you are eligible for a Government co-contribution. You are only eligible if you satisfy the following conditions:

- Your total income is less than $58,445 (the higher income threshold for FY 2024) and you make personal (after-tax) super contributions to your SMSF.

- 10% or more of your total income was from eligible employment, running a business or a combination of both.

- You were less than 71 years old at the end of the income year.

- You did not hold an eligible temporary resident visa at any time during the year (unless you were a New Zealand citizen or the holder of a prescribed visa).

- You lodged an income tax return for the relevant income year in a personal capacity and for the SMSF.

- Your total superannuation balance was less than the transfer balance cap ($2 Million for the 2026 financial year) at the end of 30 June for the previous income year

- Have not contributed more than your non-concessional contributions cap

Personal super contributions (also called non-concessional contributions) are the amounts you contribute to your SMSF which are:

- Additional contributions that you contribute from your after-tax income besides employer contributions, and

- Not a salary-sacrifice arrangement.

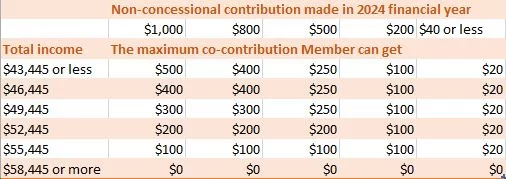

The co-contribution is 50 cents in the dollar for incomes up to $43,445 and phases out as described below. You can get a maximum co-contribution up to $500 when you make a non-concessional contribution of $1,000 to your SMSF account:

To calculate your super co-contribution, you can use the live tool on the ATO website by clicking here.

To apply for a government co-contribution, Trustees need to:

- Lodge the tax return for the SMSF for the Financial Year; and

- Lodge the Trustee’s personal tax return for the same year.

The Tax Office will work out the amount of government co-contribution the Trustee is entitled to and the government co-contribution will be paid directly to your SMSF. If you have more than one SMSF, and you want your co-contribution to be paid to a particular one, you can fill in the Superannuation Fund Nomination form.

If you no longer have an eligible super account, the ATO will send the refund cheque directly to you. This will be applicable when you are retired and no longer have an eligible super account or if you were retired but have returned to work and do not have an eligible super account.

The Tax Office will send a cheque to the Fund to be deposited into the bank account for the co-contribution. To make a claim for a direct payment, you can fill in the Application for direct payment of Government Super Co-contribution form.

For more info about what you can contribute to your SMSF and the contribution caps, please see here.