When a Member sells a small business, the proceeds are taxed concessionally if contributed to an SMSF. However, there are Capital Gains Small Business concessions that apply to provide a measure of Capital Gains Tax (CGT) relief on the sale of the business apart from the general 50% CGT discount from an individual’s perspective. To be eligible for the small business concessions, we explain the rules below.

These small business concessions are generally treated as a non-concessional contribution. To exclude this amount being counted towards the Member’s non-concessional cap, the Member must complete a Capital gains tax cap election form (NAT 71161) at the time the contribution is made. Then the contribution will be counted towards the Member’s CGT cap.

Small Business tax concessions

There are four types of CGT Small Business tax concessions available for Members who decides to sell their business:

Small Business 15 year Exemption

If a Member who owned a business for 15 years, is aged 55 or over, retiring or are permanently incapacitated and contribute the business sale proceeds to super, the amount can be tax free. A Member has a lifetime CGT cap of around $1.780 million (2024/25 indexed annually) that can be contributed to Super in this way. More information on the workings of this concession is available on the ATO website.

50% active asset reduction

This is the concession that is available to small business, to reduce the capital gain by 50% upon satisfying the basic conditions explained above. It is an optional concession, meaning that you do not have to apply it. This 50% reduction is available for the remaining capital gain after applying any normal CGT discount. A thorough explanation of the basic conditions is provided on the ATO website.

Small Business Retirement Exemption

The remaining capital gain, after applying the general 50% CGT discount and optional 50% active asset reduction, can be eliminated by applying the CGT retirement exemption. This amount will be tax free given the amount is under the lifetime limit of $500,000. More information on this concession is available on the ATO website.

Small Business rollover

This concession generally allows you to defer all or part of the capital gain from a CGT event that happens in relation to a small business for two years. More information on this concession is available on the ATO website.

CGT Cap

This is simply the limit on the amounts that can be excluded from a Member’s non-concessional cap. This is a lifetime amount and it is indexed annually. Each time you elect to exclude an eligible contribution from the non-concessional contributions cap, your super CGT cap amount is reduced by that amount. A Member should make sure that the contribution made to the Fund as a result of CGT concession does not exceed the CGT cap amount. It currently sits at $1.705 million for 2024 financial year.

Are you eligible?

There are certain basic conditions that needs to be satisfied to be eligible for the CGT concessions. In addition to these basic conditions there are extra conditions contained for each CGT Small Business Concession listed below.

Basic conditions that needs to be satisfied are as follows:

- A capital gain must arise on disposal of the asset,

- Either your business turnover is less than $2 million, or the net value of your assets and the assets of entities connected with you is less than $6 million (this excludes personal use assets); and

- The asset disposed must be an “active asset”.

This page consists of a summary of the CGT Small Business Concessions available for small business owners. More information on the rules that is applicable to these CGT concessions is available on the ATO website.

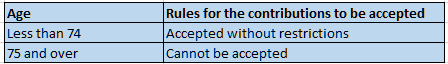

Age restrictions to consider when contributing:

More information on contributions are explained in our contributions page.