The Bring-forward rule is a provision that allows Members to make non-concessional contributions (after-tax contributions) amounting to more than the contributions cap of $120,000 over a three-year period. The limit was $110,000 from 1 July 2021 to 30 June 2024.

You cannot make any non-concessional contributions if your total super balance on 30 June of the prior year is greater than or equal to the general transfer balance cap ($1.6 million for FY2017–21; $1.7 million for FY 2022-23; $1.9 million from FY2024).

Members can make up to 3 years’ worth of non-concessional contributions in the First Year by bringing forward the caps of the next 2 years. Previously, this rule was only applicable to those under the age of 67 or 65, please click here for more info. From 1 July 2022, this rule will now apply to those under the age of 75.

Bring-Forward Provision for People Under 75

If you are under 75 years old and you make excess non-contributions, the bring-forward rule will automatically be triggered and bring forward the next two years’ non-concessional contributions – but certain conditions apply. This means:

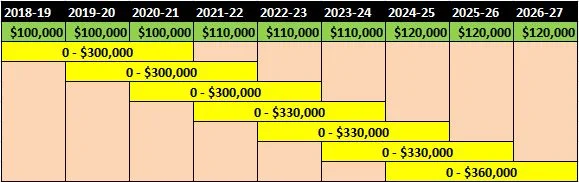

- If the bring-forward rule is triggered after 1 July 2017, you can make a total of $300,000 over a three-year period as your non-concessional contributions.

- If the bring-forward rule is triggered after 1 July 2021, you can make a total of $330,000 over a three-year period as your non-concessional contributions.

- If the bring-forward rule is triggered after 1 July 2024, you can make a total of $360,000 over a three-year period as your non-concessional contributions.

When the non-concessional contributions made to your SMSF exceed $120,000, the bring-forward rule is automatically triggered. Once this happens, the normal non-concessional contributions cap does not apply to the next two years. However, the total non-concessional contributions for the three-year period cannot exceed $360,000.

If you make any more non-concessional (after-tax) contributions to your SMSF, you will have to pay excess non-concessional contributions tax. You will receive a letter from the ATO in regards to the excess non-concessional contributions. Please click on the button below to see an example of the ATO letter:

Note:

- Excess concessional contributions (before-tax contributions) count towards the non-concessional contributions cap and can trigger the bring-forward provision.

- Life insurance premiums and fund fees can count as contributions.

For more info on how much you can contribute to your SMSF and the applicable interest rates charged by the Tax Office on excess contributions, please see the ATO website by clicking here.

Bring-forward rule for individuals who are turning 75

From 1 July 2022, the bring-forward rule cannot be utilised by those who are aged 75 or over. The maximum amount an individual aged over 75 can contribute is $120,000 per annum. In addition, in order to make contributions to your SMSF, you are required to satisfy the work test. Excess non-concessional contributions should be withdrawn from the SMSF; otherwise, the excess amount may be taxed at your marginal tax rate.

- Before you turn 75

If you are aged 74 years or younger on 1 July 2022, you can take advantage of the bring-forward rule for the entire Financial Year. This means that you can make a $360,000 non-concessional contribution in the Financial Year that precedes the year in which you turn 75, assuming that the bring-forward rule has not been triggered in previous years. - After you turn 75

You can still make up to $120,000 of non-concessional contributions to the SMSF within 28 days after the end of the month in which your 75th birthday.

Your ability to use the bring-forward rule for non-concessional (after-tax) super contributions depends on your total super balance (TSB) as of 30 June of the previous financial year. Here’s a simplified breakdown:

TSB under $1.66 million: You can bring forward up to $360,000 over three years.

TSB between $1.66 million and $1.78 million: You can bring forward up to $240,000 over two years.

TSB between $1.78 million and $1.9 million: You can contribute up to the annual cap of $120,000.

TSB of $1.9 million or more: You cannot make further non-concessional contributions.

These thresholds are effective from 1 July 2024 and are subject to annual review.

To be eligible for the bring-forward arrangement, you must also be under 75 years of age on 1 July of the financial year you intend to make the contribution.

General questions around the bring-forward provision

The following points are aimed at helping Trustees who are still confused about how the bring-forward provisions work and how to use it to their advantage.

The bring-forward applies to each Member of the SMSF. Each Member can potentially contribute up to $330,000 (FY 2022/2023) and onwards when the bring-forward rule is triggered. However, the bring-forward rule only applies to those under 75 years of age.

The bring-forward rule only applies to future years’ contributions. If you fail to utilise your non-concessional cap for one or more years, then the cap for those years can’t be carried forward.

The bring-forward provision allows you to maximise your total non-concessional contributions for a total of $360,000 (FY 2023/2024) in Year 1, rather than over a three-year period. However, in order to gain maximum benefit from it, it is important that you understand how the rule works.

If you want to contribute more after triggering the maximum cap of 3 year rule, you would need to wait until Year 4, when the bring-forward is reset.

The contributions you make for the first home saver super scheme will be allocated to a separate account which is distinguished from the guaranteed employer contributions. Our accounting system can accommodate this new change and a separate single line item will be displayed in the SMSF Financial Statements showing the first home super saver contributions.

For more information, please see the ATO page here.