Definition

From the 2020 financial year, the carry forward rule allows Members to contribute unused concessional contribution cap from up to 5 previous financial years.

To use your unused cap amounts your total super balance at the end of 30 June of the previous financial year needs to be less than $500,000. You are then able to add unused amounts to your original concessional contributions cap of $27,500 ($30,000 from 1 July 2024).

$500k Maximum Red Alert!!

Make sure your SMSF balance, including grossed up loans, is under $500k to utilise this carry-forward provisions.

If your Superannuation balance (grossed up) is over the $500k limit, the carry-forward provisions cant be used. You are then limited to the annual Concessional Contributions cap.

Remember that if you exceed your concessional contributions cap, the excess concessional contributions (ECC) are included in your assessable income. ECC are taxed at your marginal tax rate less a 15% tax offset to account for the contributions tax already paid by your super fund.

Example

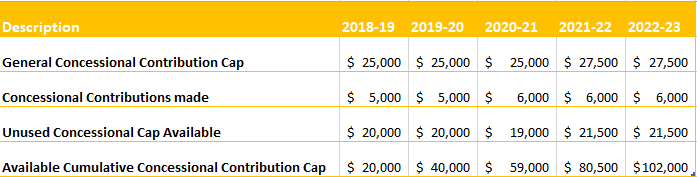

John is an employee and only receives super guarantee contributions from his employer. John’s super balance is less than $500,000 over the five years. John has a significant unused portion. John could utilise carry-forward concessional contributions to use any of this unused cap by making addition contributions into his super. In financial year 2022/2023, John could make a $102,000 concessional contribution to super on top of the $6,000 he receives from his employer.

The ATO have a full index of listings regarding the concessional contributions cap amount and unused amount. For more information please refer to the ATO website here.

Non-Concessional Contributions

For more information on contributions, please see here for more on non-concessional contributions and the provision regarding the bring forward rule specifically for non-concessional contributions.