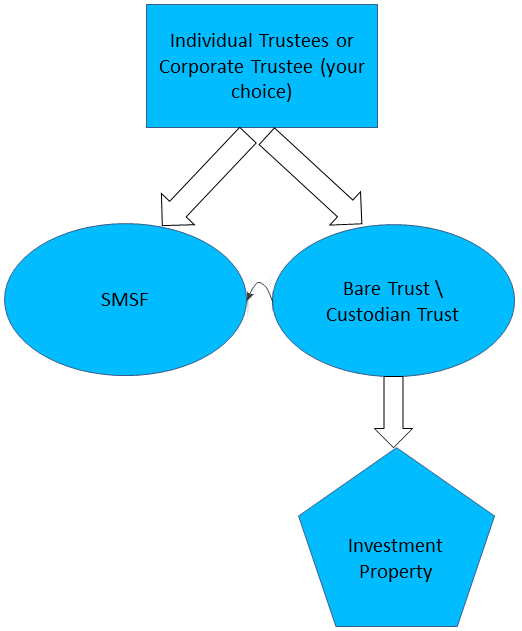

A related party loan is where the Members of an SMSF act as the Bank towards the Fund. They will lend money to the SMSF instead of a Bank. A line of credit mortgage can be used for Members to obtain the Loan in their personal capacity and then on-lend the money to the SMSF. The typical structure is set out below:

The structure for the related party loan can be more cost effective because there is no legislative requirement to set up a Corporate Trustee and a Custodian Trustee. The related party loan can be simply held by the Bare Trust/Custodian Trust with Individual Trustees. Unlike a related party loan, if the SMSF intends to buy properties with bank loans, a Corporate Trustee and a Custodian Trustee are required to be set up by most Banks.

When we set up the related party loan structure for your SMSF, we will provide you with all the necessary documentation and also a loan schedule showing the loan details and the monthly repayment. The sample loan repayment schedule is noted below.

Arm’s Length & Commercial Terms

It’s important to ensure the terms of lending to the SMSF are on an arms-length basis and issued on commercial terms. This means the Members need to charge a reasonable amount of interests on the loan to the SMSF. The ATO provides the annual LRBA safe harbour interest rates as noted in the table below:

Safe Harbour Interest Rates

| Year | Real Property | Listed Shares or Units |

| 2024 – 2025 | 9.35% | 11.35% |

| 2023 – 2024 | 8.85% | 10.85% |

| 2022 – 2023 | 5.35% | 7.35% |

| 2020 – 2022 | 5.10% | 7.10% |

| 2019 – 2020 | 5.94% | 7.94% |

| 2018 – 2019 | 5.80% | 7.80% |

| 2017 – 2018 | 5.80% | 7.80% |

There is a school of thought that argues zero % interest related party loans is acceptable, however we believe this could put the Fund in risk as the transactions are not on an arm’s length basis.

FAQ:

-

Can I use the Terms and Conditions from a Commercial Lender rather than the Safe Habour Rulings for the Related Party Loan in my SMSF?

Safe harbour rulings is a safety net. If SMSF Trustees choose to use this rate or the terms noted in the safe harbour provisions, Trustees can have certainty that the non-arm’s length income (NALI) provisions won’t apply to the arrangement.

If the Trustee chooses not to apply the guidelines, that doesn’t mean that the Fund automatically triggers the NALI provisions. It just means that the Fund doesn’t have the certainty of that safety net. The Trustee needs to be able to demonstrate that the arrangement is consistent with a commercial dealing. The Trustee will need some documentary evidence that the Related Party Loan’s terms and conditions are the same as those available from a commercial financier.

The following is an sample reasoning noting the Loan terms and conditions are on commercial terms and at market rates:

The Interest Rate shall be 6% being a commercial term based on Trustees objective is to execute the loan on commercial terms and on an arm’s length basis

1. Interest rate – based on a commercial interest rate at 6% charged by a commercial financier

2. Loan term/period – continuation of existing loan term which is 30 years and 27 years remaining

3. Loan Amount – more conservative LVR ratio than current arrangement

4. Conditions – Loan agreement, Loan schedule and Minutes

Formal execution by signing and executing the loan agreement and repayment schedule. -

Can I refinance my existing Bank Loan in the SMSF with a Related Party Loan?

As per Section 67A(1)(a)(ii) of the SIS Act 1993, the Trustee of an SMSF can refinance an existing borrowing provided it is over the single acquirable asset the subject of the borrowing and no other asset. As such a new related party loan can replace some or all of the existing Bank LRBA. Please note the monies from the related party lender should be transferred directly to the Bank to ensure the SMSF meets the requirements of the law applying to LRBAs. It is the Trustee’s responsibility to register the related party mortgage over the property as per the safe harbour rulings.

Safe Harbour Provisions

The Tax Office has recently published a practical compliance guidance (PCG 2016/5) which sets out the recommended interest rate and the loan terms (called ‘safe harbour’ terms) for a related party loan. For SMSF Trustees with Limited Recourse borrowing arrangements (LRBAs) which do not meet the ‘safe harbour’ terms in the practical compliance guidance cannot be assured that the Commissioner will accept the arrangement to be consistent with an arm’s length dealing. However, this does not mean that the arrangement is deemed not to be on arm’s length terms. It merely means that there is no certainty provided under the practical compliance guidelines. Trustees will need to be able to otherwise demonstrate that the LRBA was entered into and maintained on terms consistent with an arm’s length dealing.

Safe Harbour Terms Summary

- Applicable interest rate for each year of the LBRA should be used

- The maximum loan term is 15 years

- The maximum LVR is 70%

- A registered mortgage over the property is required

- Each repayment is of both principal and interest, and the repayment is required to be paid monthly

- A written and executed loan agreement is required

Please note a sample loan repayment schedule here:

Sample Loan Repayment Schedule

An SMSF cannot lend money to a related party

Although the Members of an SMSF can lend money to their Super Fund, the SMSF cannot give a loan to a related party. It is regarded as providing financial assistance to Members and breaches the Sole Purpose Test. Please see the ATO video below for more information:

SMSF Loans & Early Access

For details on the structure to be set up for the Bank Loan, please refer to this page.

The Tax Office give further clarification in relation to this matter in the SMSFRB 2020/1.